When it comes to saving for your future, one big question you might face is: should I max out my RRSP or TFSA first? The RRSP (Registered Retirement Savings Plan) and the TFSA (Tax-Free Savings Account) are two of Canada’s most popular savings options, but knowing where to prioritize your contributions can be challenging.

This question is something I pondered myself for a long time and went back and forth on as I tried to figure out which would make the most sense for me, my lifestyle, and my financial goals.

In this post, we’ll dive into the pros and cons of each, so you can make a decision that suits your financial situation.

1. Understanding the Basics: RRSPs and TFSAs

Let’s start with the basics of these two accounts.

What’s an RRSP?

The RRSP, or Registered Retirement Savings Plan, is designed to help Canadians save for retirement. Contributions you make to an RRSP are tax-deductible, meaning they reduce your taxable income for the year you make them.

This tax benefit is particularly helpful if you’re in a higher income tax bracket now but expect to be in a lower bracket when you retire. The idea is to save on taxes by postponing them to a time when you’ll likely be earning less.

Each year, you can contribute up to 18% of your previous year’s earned income, up to a maximum set by the Canada Revenue Agency (CRA). 2024 RRSP contribution limit is $31,560, but this amount is adjusted annually for inflation. Unused contribution room also carries forward, so if you didn’t reach your limit in previous years, you can make up for it in later years.

What’s a TFSA?

The TFSA, or Tax-Free Savings Account, works a bit differently from an RRSP. Contributions to a TFSA aren’t tax-deductible, so they won’t reduce your taxable income. However, any growth within the account—whether from interest, dividends, or capital gains—is completely tax-free. This allows your savings to grow without any tax impact, both while in the account and when withdrawn.

One of the best features of a TFSA is its flexibility. You can withdraw funds at any time, penalty-free, making it suitable for a variety of savings goals beyond retirement, like buying a car, going back to school, or building an emergency fund.

Each year, the federal government sets an annual TFSA contribution limit. For 2024, this limit is $7,000, though it may change over time with inflation adjustments. Any unused contribution room carries forward indefinitely, so if you didn’t contribute the full amount in previous years, you can catch up later.

Related content:

2. Pros and Cons of RRSPs and TFSAs

Now that we’ve covered the basics, let’s dig into the unique advantages and disadvantages of each account.

Pros of an RRSP

- Tax Deduction: This can make a big difference if you’re in a higher income bracket, as RRSP contributions lower your taxable income.

- Deferred Tax: Your contributions grow tax-deferred, which allows your investments to compound more over time.

- Good for Retirement: Since RRSPs are geared towards retirement savings, they come with incentives that encourage long-term saving.

Cons of an RRSP

- Withdrawal Tax: When you eventually withdraw from your RRSP, you’ll have to pay tax on those funds. If you withdraw early, you could be hit with penalties and withholding taxes.

- Not as Flexible: Because it’s meant for retirement, the RRSP isn’t as flexible if you need funds in the short term. It can be accessed for certain purposes like the Home Buyer’s Plan, but these options are limited.

Pros of a TFSA

- Tax-Free Growth: Growth within a TFSA is tax-free, which means you won’t owe a penny on any gains you make.

- Flexible Withdrawals: You can take money out whenever you like without tax penalties, making it great for shorter-term goals or goals with uncertain timelines.

- No Impact on Government Benefits: Unlike RRSP withdrawals, which can impact income-tested government benefits, TFSA withdrawals don’t affect these benefits.

Cons of a TFSA

- No Immediate Tax Deduction: Unlike RRSPs, TFSAs don’t provide any immediate tax deductions, so if you’re in a high tax bracket, they might not provide as much upfront tax relief.

- Contribution Limits: Contribution room for a TFSA is capped annually, and unused room rolls over. This might limit the amount you can save compared to an RRSP if you’re a high-income earner.

3. When You Might Prioritize Your RRSP

Here are some scenarios where prioritizing an RRSP might make the most sense.

3.1 You Have Employer Matching

Some employers offer RRSP matching programs, which means that for every dollar you contribute, your employer contributes a certain percentage as well. This is essentially free money, and maximizing this opportunity can be a highly effective way to grow your retirement savings.

For example, if your employer matches contributions up to 5% of your $100,000 salary, prioritizing RRSP contributions to take full advantage of this match can significantly accelerate your retirement fund. By contributing 5% of your salary, you’re effectively contributing 10%—or $10,000—toward your RRSP, with half of that amount coming from your employer, without any additional impact on your paycheck.

3.2 You’re in a High Tax Bracket Now

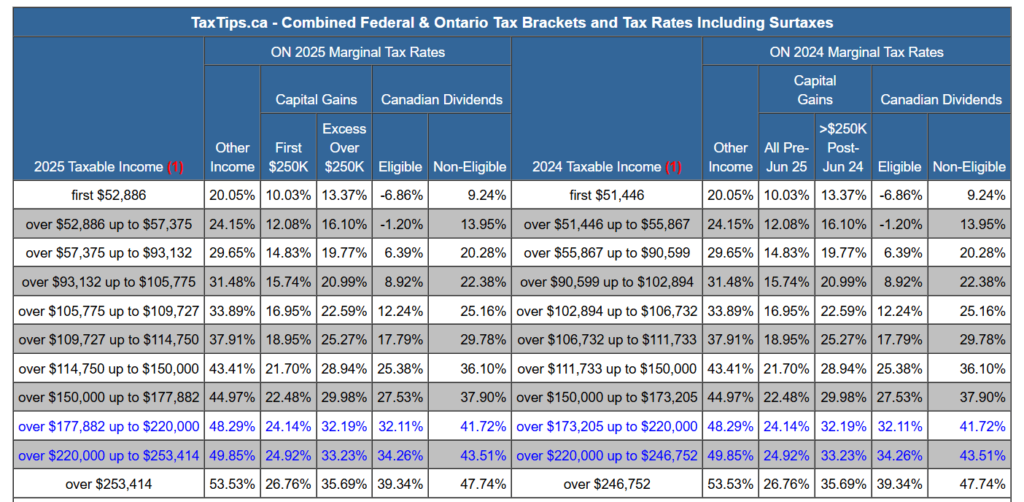

Source: TaxTips.ca

If you’re currently in a high tax bracket, you’ll benefit more from the tax deduction that comes with RRSP contributions. When you retire and are likely in a lower tax bracket, you can withdraw these funds with a reduced tax impact.

For example, if you’re based in Ontario with an annual taxable income of $135,000 and you contribute $20,000 to your RRSP in 2024, your taxable income would decrease to $115,000. With a marginal tax rate of 43.41%, the expected tax refund from this contribution would be calculated as follows: ($135,000 – $115,000) x 43.41% = $8,682.

3.3 You’re Expecting a High-Earning Year

If you anticipate a spike in income—such as a bonus or business gains—maximizing your RRSP can help offset that additional income and potentially keep you in a lower tax bracket.

For example, if you’re expecting a bonus that will increase your annual income from $110,000 to $125,000 by the end of 2024, this could push you into a higher tax bracket, from 37.91% to 43.41%. By contributing $13,267 (the difference between $125,000 and the $111,733 threshold) to your RRSP, you could reduce your taxable income back into the 37.91% bracket, minimizing the tax impact of your higher earnings.

3.4 You’re Planning for the Purchase of Your First Home

RRSPs offer special programs like the Home Buyers’ Plan (HBP), which allows first-time homebuyers to withdraw up to $60,000 tax-free for a down payment, as increased in Budget 2024. Maximizing your RRSP contributions before withdrawing under the HBP can help grow your funds faster, enabling you to take full advantage of this opportunity.

4. When You Might Prioritize Your TFSA

And here are some instances where putting money in your TFSA first could be a smarter move.

4.1 You’re in a Low Tax Bracket Now

If you’re currently in a low tax bracket, the immediate tax savings from an RRSP aren’t as significant. You may prefer to invest your money in a TFSA, where it can grow tax-free and be more accessible.

For instance, if you’re based in Ontario with an annual taxable income of $60,000 and fall into a 29.65% tax bracket, you might consider reducing your tax bracket to 24.15%. To achieve this, you’d need to contribute $4,133 to your RRSP—the amount needed to lower your income to the $55,867 threshold. This contribution would yield a tax refund of approximately $1,225 ($4,133 x 29.65%), which may not seem significant. Alternatively, rather than contributing $4,133 to your RRSP and deferring taxes until withdrawal, you could instead contribute the amount to your TFSA, allowing it to grow tax-free.

By contributing to a TFSA while in a low tax bracket, you can save your RRSP contribution room for future years when you might be in a higher tax bracket, such as when you receive a bonus or a salary increase. In those years, the tax savings from RRSP contributions will be much more beneficial.

4.2 You Need Flexibility

The TFSA is significantly more flexible than an RRSP. If you’re saving for something other than retirement or want the option to withdraw funds without penalties, the TFSA is often the better choice.

Since you can withdraw funds tax-free and re-contribute the following year, TFSAs are ideal for goals with uncertain timelines.

4.3 You Want to Avoid Affecting Benefits

TFSA withdrawals don’t affect your income-tested government benefits. If you rely on these benefits or want to keep your future options open, a TFSA provides flexibility without the tax consequences associated with RRSP withdrawals.

With TFSA withdrawals, you can supplement your retirement income without increasing your taxable income. This can help you avoid a higher tax bracket and preserve your eligibility for benefits like Old Age Security (OAS).

5. Blending Both Accounts: The Best of Both Worlds

Sometimes, a combination approach is the ideal solution. Here’s how it could look:

5.1 Start with Your TFSA

If you’re young, early in your career, or in a low tax bracket, it may be wise to prioritize your TFSA. This allows your savings to grow tax-free, and you can shift to your RRSP later when your income rises, and tax savings become more beneficial.

5.2 Maximize Your RRSP When Your Tax Bracket Increases

As your income grows, you can pivot to making RRSP contributions to take advantage of the tax deduction. Eventually, you might even split your contributions, putting some in both accounts if you can.

5.3 Use RRSP Refunds to Fund Your TFSA

Here’s a trick: you can use the tax refund you receive from contributing to your RRSP to fund your TFSA. This way, you’re essentially benefiting from both accounts without straining your budget.

For example last year, I received a sizable tax refund from my RRSP contributions. Instead of splurging on something I didn’t really need, I decided to put that refund straight into my TFSA. It felt like a win-win because I’d maximized my RRSP benefits and then built my TFSA in the same year.

Related content:

6. Which One Should You Max Out First?

Ultimately, the decision between maxing out your RRSP or TFSA first depends on your current financial situation, future goals, and personal preferences. Here’s a quick recap:

- If you’re in a high tax bracket and focused on retirement or buying your first home using the Home Buyers’ Plan (HBP), and you’ve already maximized your contributions to your First Home Savings Account (FHSA), the RRSP might be the better choice for now.

- If you’re in a low tax bracket and seek more flexibility, the TFSA could be the better option.

- If you want to blend both strategies, consider contributing to both accounts or using your RRSP refund to top up your TFSA.

Final Thoughts

Choosing between your RRSP and TFSA is a personal decision that depends on your current financial situation, future goals, and unique needs. If you’re in a higher tax bracket, focused on retirement savings, or planning to buy your first home, prioritizing your RRSP could provide immediate tax benefits and set you up for long-term success. Conversely, if you’re looking for flexibility, tax-free growth, or a way to supplement your income without impacting government benefits, the TFSA might be your best bet.

For many Canadians, blending both accounts offers the perfect balance, allowing you to enjoy the strengths of each as your income and goals evolve. I’ve personally tried a bit of everything: prioritizing my RRSP, then focusing on my TFSA, and eventually using both to support my different financial goals.

There’s no one-size-fits-all answer. Take the time to reflect on your financial priorities, adjust your strategy as needed, and make the most of these tax-advantaged accounts to reach your financial goals with confidence.